All about Demat Account

A Demat Account ensures a simple, seamless, paperless, genuine trading and investing experience.

To open a Demat Account, you need to provide certain documents that will go through the KYC process.

Take a step in the right direction. Open Your Demat account in 15 mins*

Documents required to open a Demat Account

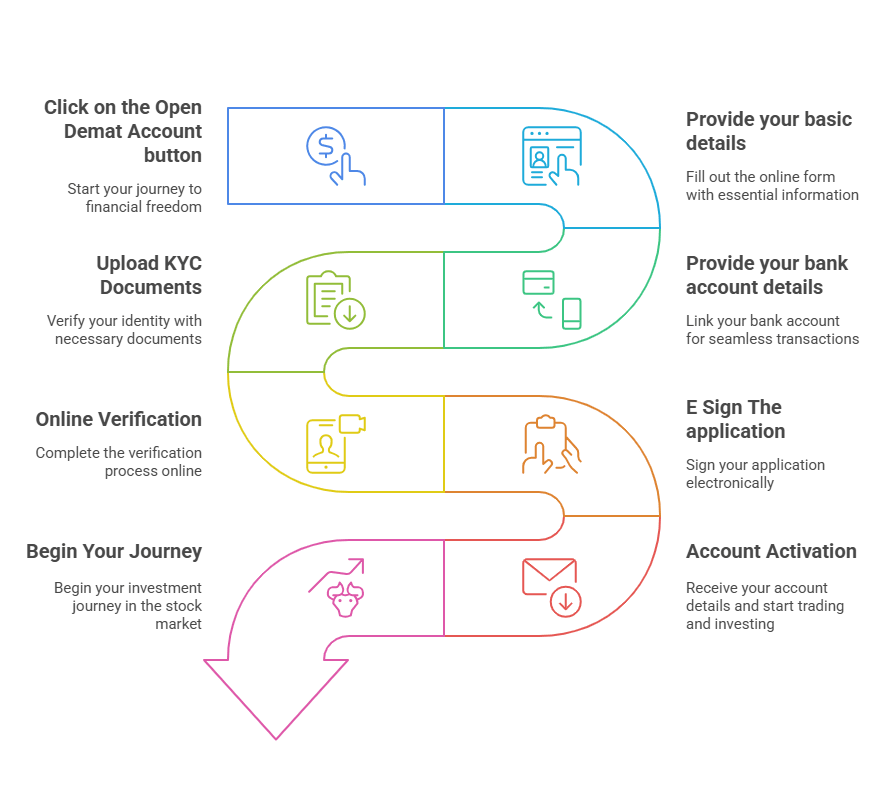

We strongly advice you to open your account via the Do-It-Yourself (DIY) 100% online journey that takes merely 15 mins*. Here is the journey flow in simple steps.

For Individual Account Opening

Document list for Identity Proofs

- Pan Card (Mandatory)

- Aadhaar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

Proof Of Documents for Permanent Address

- Aadhar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

- National Population Register Letter

Proof Of Documents For Correspondence Address

- Aadhar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

- Utility bill which is not more than two months old of any service provider (electricity, telephone, piped gas, water bill)

- Property or Municipal Tax receipt

- Pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings if they contain the address

- Letter of allotment of accommodation from employer issued by State or Central Government departments, statutory or regulatory bodies, public sector undertakings, scheduled commercial banks, financial institutions and listed companies

Bank proofs

- Personalized cheque leaf

- If not personalized, then Cheque leaf + Bank Statement/Passbook (not more than six month old)

- Bank Statement/Passbook with IFSC & MICR

F&O and Derivative proofs

- DP Holding statement – Latest statement with holding value greater than Rs. 25,000.

- Copy of the ITR acknowledgment – Latest ITR acknowledgment with total value of annual income greater than Rs. 1.20 lakhs clearly specified.

- Copy of Form 16 – Latest document with total value of annual salary greater than Rs. 1.20 lakhs.

- Salary Slip – Latest salary slip with value of monthly salary greater than Rs. 10,000 per month.

- Net Worth Certificate – Latest net worth certificate issued by any practicing Chartered Accountant with value of net worth greater than Rs. 1.20 lakhs.

- Copy of Annual Accounts – Latest annual account statement with annual income greater than Rs. 1.20 lakhs.

- Bank Statement – Latest 6 months’ bank statement with value of at least one transaction greater than Rs. 10,000 and the current closing balance in the statement should be Rs. 10,000. In case every month there is a credit of salary in the account which satisfies the criteria specified above (> Rs.10,000 per month), then the account closing balance in the bank account can be less than Rs.10,000.

For HUF Account Opening

Document list for Identity Proofs

- Pan Card (Mandatory)

- Aadhaar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

- Next Karta should be senior most member of the family, except married daughters.

- New Karta shall submit the new list of members.

- Notarized copy of death certificate of the deceased Karta.

- No Objections Certificate from the surviving members of the HUF for him.

- Transmission & Form 40.

- HUF Declaration on demise of Karta.

Proof Of Documents For Permanent Address

- Aadhar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

- National Population Register Letter

Proof Of Documents For Correspondence Address

- Aadhar Card

- Voter ID

- Valid Driving Licence

- Valid Passport

- NREGA Job Card

- Utility bill which is not more than two months old of any service provider (electricity, telephone, piped gas, water bill)

- Property or Municipal Tax receipt

- Pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings if they contain the address

- Letter of allotment of accommodation from employer issued by State or Central Government departments, statutory or regulatory bodies, public sector undertakings, scheduled commercial banks, financial institutions and listed companies

Bank proofs

- Personalized cheque leaf

- If not personalized, then Cheque leaf + Bank Statement/Passbook (not more than six month old)

- Bank Statement/Passbook with IFSC & MICR

F&O and Derivative proofs

- DP Holding statement – Latest statement with holding value greater than Rs. 25,000.

- Copy of the ITR acknowledgment – Latest ITR acknowledgment with total value of annual income greater than Rs. 1.20 lakhs clearly specified.

- Copy of Form 16 – Latest document with total value of annual salary greater than Rs. 1.20 lakhs.

- Salary Slip – Latest salary slip with value of monthly salary greater than Rs. 10,000 per month.

- Net Worth Certificate – Latest net worth certificate issued by any practicing Chartered Accountant with value of net worth greater than Rs. 1.20 lakhs.

- Copy of Annual Accounts – Latest annual account statement with annual income greater than Rs. 1.20 lakhs.

- Bank Statement – Latest 6 months’ bank statement with value of at least one transaction greater than Rs. 10,000 and the current closing balance in the statement should be Rs. 10,000. In case every month there is a credit of salary in the account which satisfies the criteria specified above (> Rs.10,000 per month), then the account closing balance in the bank account can be less than Rs.10,000.

Steps to open your demat account

Click on the Open Demat Account Button on The Top Right Side Of This Page

Provide your basic details Complete the online demat account opening form by giving your basic details such as your name , address ,pan card number ,contact details etc.

Provide your bank account details Link your existing bank account with your demat account .This is important as only then would you be able transfer the funds between the two for your investment or trading activities in the stock market. Also the bank account linked to the demat account is important to receive dividends.

Upload KYC Documents You ll need to upload scanned copies of you’re your KYC documents like : PAN card , Aadhar Card, Cancelled cheque of your linked bank account .

Online Verification Many DPs conduct an online In-Person Verification (IPOV) or a video KYC process. You might need to record a short video of yourself or connect with a representative online for verification.

E Sign The application Most DPs offer the option to e-sign the account opening form using your Aadhaar-linked mobile number and OTP (One-Time Password). This makes the process completely paperless.

Account Activation Once your application and documents are verified, the DP will activate your Demat account. You will receive your account details (DP ID and Client ID) usually via email and SMS.

Start Trading Once your account is active, you can link it to your trading account and start buying and selling securities in electronic form.

A Demat account is your first step to investing or trading in the stock markets. To activate the derivatives segment, you first need to have an active demat cum trading account .