Trade Smart with Options – Powered by Safal Finedge

At Safal Finedge, our Options Trading solutions give you the strategic edge to navigate the Futures & Options (F&O) segment with confidence and clarity. Options are powerful derivative contracts that grant you the right—but not the obligation—to buy or sell an underlying asset (like stocks, indices, commodities, or currencies) at a specific price before a set expiry date.

Our platform empowers clients with leverage-driven trading, allowing you to gain exposure to high-value assets with a fraction of the capital. Whether you’re hedging risks or speculating on market movements, we equip you with real-time insights, expert tools, and strategic support to take informed trading decisions.

With in-depth research, advanced market analysis, and personalized guidance, we simplify the complexities of options trading. Backed by a client-centric approach and intuitive execution platforms, Safal FinEdge makes options trading accessible, efficient, and results-driven—for both novice traders and seasoned market participants.

Master Options with Expert-Led Strategies

Defined Risk, Unlimited Potential

Advanced Tools for Smart Decisions

Flexible Contracts for Every Trader

Why Professional Traders Use Hedging?

Minimizes losses if the market moves against your position.

Acts like insurance by protecting against downside risk.

Used by professionals as a strategic risk management tool.

Allows selling the asset at a fixed price even if the market drops.

We help speculators trade boldly with strategy and insight.

At Safal Finedge, we support clients who seek to profit from price movements through options speculation. Unlike hedging, where the focus is on minimizing risk, speculating in options involves taking calculated risks with the goal of earning higher returns.

Our platform enables you to act on your market outlook—whether you’re bullish or bearish—by equipping you with data-driven tools, expert guidance, and strategic insights to execute with precision.

Let’s say the Nifty 50 index is at 23,000, and your analysis suggests it will rise. You choose to buy a Call Option at a strike price of 23,200. If the index moves above 23,200 before expiry, you profit. If not, you only lose the premium paid—your risk is limited, but the potential upside can be significant.

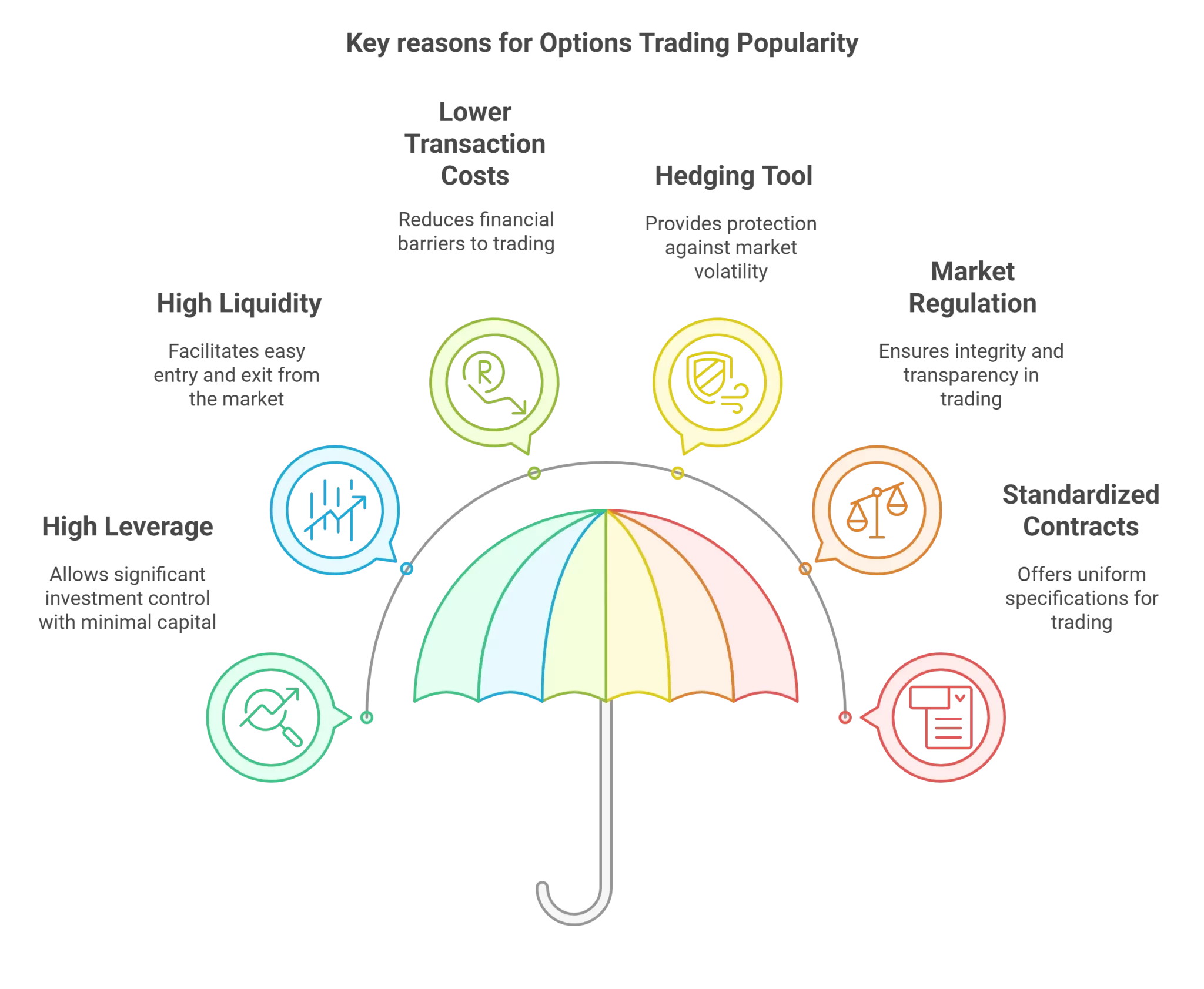

Why Options Trading is Gaining Popularity

High Returns with Low Capital

Options offer high leverage, allowing traders to control large positions with relatively small investments—often leading to attractive returns compared to traditional stock trading.

Easy Entry & Exit with Liquidity

The high liquidity of the options market ensures smooth order execution and minimal price slippage, making it ideal for both short-term and long-term traders.

Low Trading Costs

Options trading involves lower transaction costs due to reduced government levies and brokerage charges—keeping your overall trading expenses in check.

Get Started in 3 Easy Steps

Step 1

Open Your Demat + Trading Account

Fill in your basic details and upload your KYC documents (PAN, Aadhaar, cancelled cheque) through our 100% online process.

Step 2

Account Verification

Once your documents are verified, your demat cum trading account gets activated—usually within 15 minutes*.

Step 3

Activate F&O Segment

To enable Options (F&O) trading, simply upload your proof of income—done easily via our app or website.

Get started

Schedule your personalized consultation today!

We are better together.

Drop your contact details into the form, and we’ll reach out to you!

OR REACH US AT:

C-72, East End Apartment,

Mayur Vihar Phase-I, Extension,

Delhi-110096

T: +91 88004-77472

E: info@safalfinedge.com