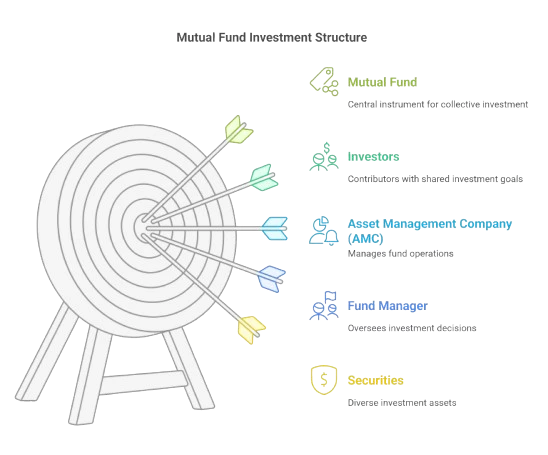

What is a Mutual Fund ?

A mutual fund is an instrument which collects money from many investors having a common investment goal. The money is collected by an Asset Management Company (AMC), which appoints a professional fund manager who invests the money collected by the investors in a diversified portfolio of securities. The securities may include :

- Equities:-or shares of publicly listed companies.

- Bonds:- loans made to the governments or companies.

- Money Market instruments:- short-term, low-risk debt instruments like Treasury bills(T-Bills) and Commercial Bills.

- Other Assets: may invest in gold, REITS(Real estate investment trusts) and others, depending on the fund’s mandate.

Start your Mutual Fund journey with us now !

Unlike investing in shares, when you invest in mutual funds, you buy units of that fund with your investments. The value of each unit is known as Net Asset Value(NAV), which in turn represents the market value of the fund’s holding (in various securities) per unit after deducting all expenses. The NAV is calculated daily at the end of the trading day.

To understand better, let us say you and your friends decide to pool their money and buy a box of assorted chocolates. Instead of each person purchasing a box of chocolates themselves, you all pool the money to buy a variety of chocolates together. Your share is represented by the money you contribute (number of units) to the pool. You and your friends appoint a chocolate manager (fund manager) whose duty is to decide which chocolates to buy and sell based on the group’s liking.

How is a mutual fund set up ?

In India, setting up a mutual fund involves several key entities and is done under the close watch of SEBI. It is a multistage process and a heavily regulated industry ensuring that investors’ interest is protected as well as the growth of the mutual fund industry is orderly.

Setting up a Trust

A mutual fund can be set up only as a trust under the Indian Trust Act of 1882. Like a promoter is required to establish a company, a sponsor establishes the trust. The sponsor must meet specific eligibility criteria set up by SEBI and contribute at least 40 % of the net worth of the AMC.

Appointing Trustees

Trustees are thereafter appointed to oversee the operations and ensure the interests of the investors(unit holders) are well protected. SEBI regulations require that the trustees appointed (at least 2/3rd) be independent, i.e., they should not be associated with the sponsors.

Incorporation of Asset Management Companies

The sponsor appoints an AMC which must be registered and approved by the SEBI before they can begin. The AMCs must meet a minimum net worth criterion(currently INR 50 Crore) and be qualified with prior experience in the financial services industry. A minimum of 50% of the directors of the AMCs must be independent.

Appointing a Custodian and Registrar&Transfer Agents(RTA)

A Custodian (registered with SEBI) holds the securities and assets of various fund schemes in its custody.

The RTA handles customer queries, processing applications, redemption, etc.

Filing Application,Review and Approval with SEBI

With all the necessary documents, the AMC files an application with SEBI for registering the mutual fund. The application includes detailed information on the fund's structure, investment objective, risk mitigation strategies and details of the sponsor, trustees, etc.

SEBI thereafter conducts its due diligence and grants the certificate of registration.

Start your Mutual Fund journey with us now !

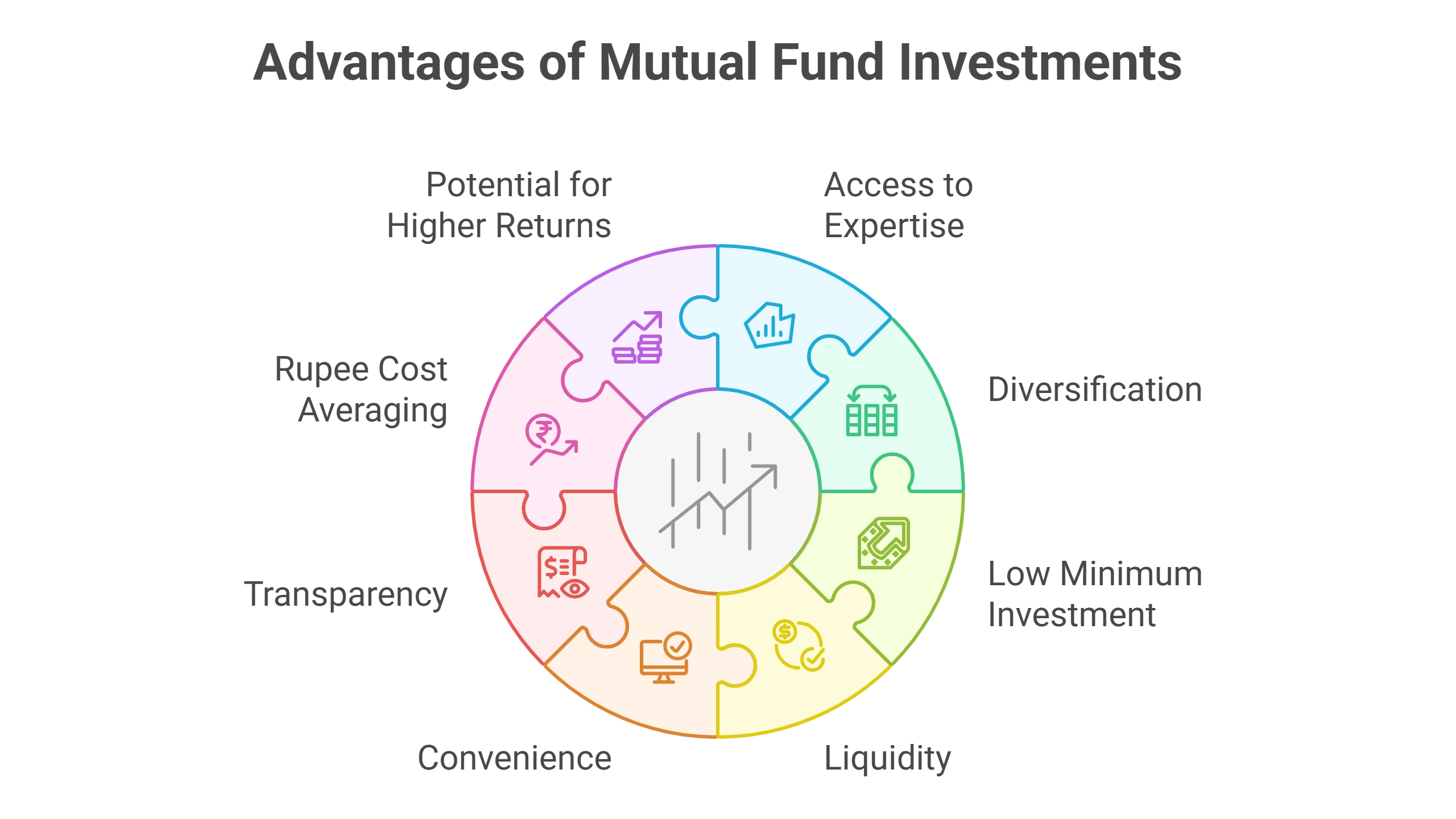

Why should you invest in mutual funds ?

The mutual fund route is one of the popular investment vehicles for retail investors interested in investing in the financial markets. Some of the key advantages of investing in mutual funds are :

- Access to investing expertise at a low cost: As a mutual fund investor, you get access to experienced, knowledgeable fund managers who have the expertise and resources to make informed investment decisions on your behalf. They are in constant touch with the stock markets and have sophisticated tools and a dedicated team to analyze company fundamentals, industry trends, etc. They can adjust their investment decisions to meet the fund’s primary goal. This is very helpful for individuals lacking the time and expertise to manage their investments actively.

- Diversification: Mutual funds spread their risks by spreading their investments in the shares of diverse companies, sectors or even in other securities like bonds, treasury bills, commodities like gold, REITs, etc. Diversifying investment across various asset classes is crucial from the risk management perspective. By spreading risk, the poor performance of any one security does not impact their overall portfolio returns.

- Low Minimum Investment: You can begin your investment journey with a relatively small investment amount, sometimes as low as Rs 500, through Systematic Investment Plans, popularly called SIPs, which make investment affordable and accessible to a wide range of investors seeking good returns in the long run.

Liquidity: Mutual fund investing brings the benefit of liquidity to its investors. As an investor, you can redeem your unit (sell) to the fund house on any business day at the prevailing NAV. The proceeds from the redemption are usually credited to your bank account in the next few working days. This ease of converting investment into cash is a significant advantage over other assets like real estate, physical gold, etc.

- Convenience: Investing in Mutual funds is a straightforward and effortless process. It can now be done from home using our mobile app or online platform.

- Transparency: With this industry being strictly monitored and regulated by SEBI, you can expect the highest transparency and disclosures in the public domain. All fund houses must disclose their investment objectives, portfolio holdings, and performances regularly. The fund house of various schemes also discloses the daily NAV so that the investors can know the value of their investments.

- Rupee Cost Averaging: Investing through SIPs lets you, as an investor, invest small amounts in the stock markets regularly. This investing approach helps in averaging out the cost of your investment, over the long term regardless of the market level. In other words, SIP investments let you buy more units when the NAV is lower and fewer units when it’s higher.

Prospects of Higher Returns in the Long run: While not assured, equity MFs have the potential to generate higher returns for their investor over traditional investments like bank fixed deposits, savings plans .

In conclusion, it gives investors a convenient, diversified and systematic way to participate in the financial markets. The professionally managed fund house with its in-house experts ensures that your investments are well managed, generating higher returns over time. All this makes mutual fund investments suitable for individuals from different financial backgrounds to achieve their financial goals. However, it is essential to consider your individual risk tolerance, investment goals and the time horizon before choosing a mutual fund.

Experience Effortless investing with Us

Whether you are an investor looking to create wealth in the long run or looking to park your funds in the short run , experience :

- Personalized Service Support: Personalized assistance ensures your unique requirements are met.

- Research-backed recommendations: We run a 360-degree qualitative and quantitative analysis so that you choose the right fund for your investment needs.

- Stress-Free Investment: You can now select and invest from a wide range of funds through our online platform or mobile app.

Start your Mutual Fund journey with us now !

FAQ’s

What is a mutual fund? How is it different from buying stocks directly?

A mutual fund is an instrument or a vehicle which collects money from various investors with a common investment objective and invests it in various listed securities like stocks, bonds and other assets. This pool of money is managed by a professional fund manager with sound knowledge and experience investing in the securities market.

It is different from buying the stocks directly from the stock market, as in the case of mutual funds, the fund manager does it for you based on research and ensures that the investment is well diversified to mitigate any potential risks.

What is an NAV, and how does it represent the value of my MF’s investment?

NAV or Net Asset Value is essentially the market value of all the mutual fund’s investments per unit after deducting all expenses. The NAV is calculated at the end of each trading day, and it tells you the current value of your investments in the fund.

Should I invest in MFs or consider picking stocks myself?

Suppose you are someone who does not do stock picking for a living, in that case, it is advisable to let a professional mutual fund manager do it for you. A mutual fund offers several advantages, like

- Expert Management – You benefit from an experienced fund manager making investment decisions for you.

- Diversification- Instead of putting all your money in a security, spreading your risk across multiple asset classes is always prudent.

- Low Min Investment- Nowadays, you can start investing with sums as low as Rs 500, which may not be the case when you pick stocks yourself.

- Liquidity- Compared to other investment vehicles, you can liquidate your investments fast and get your money in your bank account in a few working days.

- Convenience – Investing in MFs can be done from home with a few mouse clicks.

How safe is my investment in a mutual fund?

The Mutual Fund industry is strictly monitored and heavily regulated in India. Market regulator SEBI ensures a high level of transparency, and disclosures are made from time to time. The AMCs must share regular information on their holdings, performance, investment objectives, etc. This ensures that the investor’s interests are protected at all times.

As a beginner, how does an SIP route of investing in MFs help me?

SIP stands for Systematic Investment Plan, which lets you invest a fixed amount of money in the stock markets through a mutual fund. Through the SIP route, you accumulate more units when the market is low and less when it’s high, thus giving you the benefit of Rupee Cost Averaging. This leads to potentially higher returns over the long term while reducing the risk of trying to time the markets.

What kind of support and guidance can I expect from Safal Finedge if I invest through you?

As an authorized partner of Mirae Asset Sharekhan, we understand that everyone has different investment objectives and time horizons. Our recommendations are based of careful study on what could be best for you. Our ultimate goal is to make your investment experience less stressful and more rewarding for you in the long run.