Initial Public Offering (IPO)

An Initial Public Offering or IPO is the first step taken by a privately held company to become a public limited company. This is done by the process of offering its shares to the general public at large for subscription in exchange for their capital .

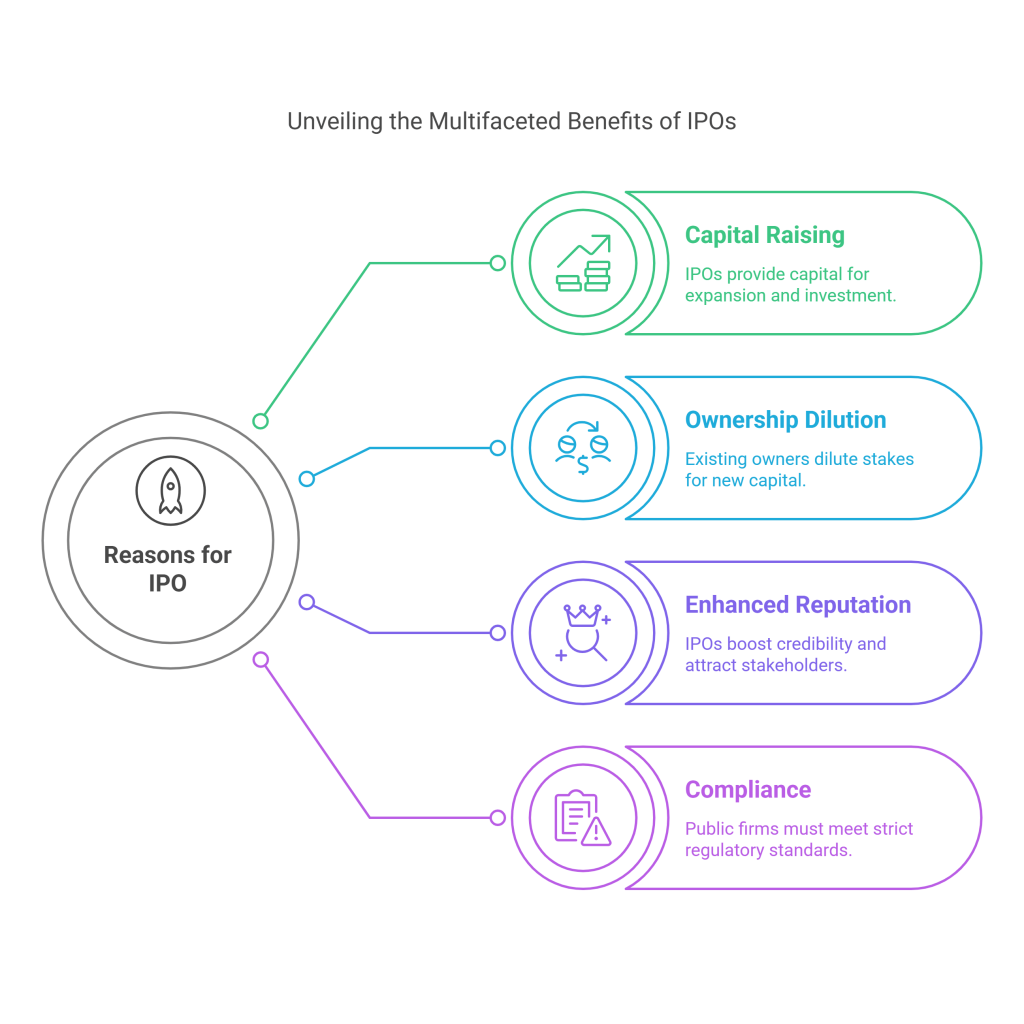

What are some key reasons for a company to go for an IPO ?

- To Raise Capital – The primary reason for a company to go public is to raise enough capital to expand business operations, invest in new technologies or machinery, acquire other companies, meet their working capital requirements, and many more reasons.

- Dilution of Ownership – In return for capital, the existing owners, like promoters, early-stage investors, etc, dilute their ownership stakes in the company.

- Enhanced Reputation and Visibility –An Initial public offering significantly improves the credibility and brand image of a company, which is helpful in growing the business as it attracts new customers, vendors, qualified managers to run and grow the business.

- Compliance – Publicly listed companies are required to meet the highest code of ethics, regulatory requirements, and reporting standards set by SEBI.This includes disclosing the financials of the company from time to time, meeting corporate governance norms, and strict adherence to exchange guidelines.

Start Investing In Initial Public Offering(IPO)

The IPO process

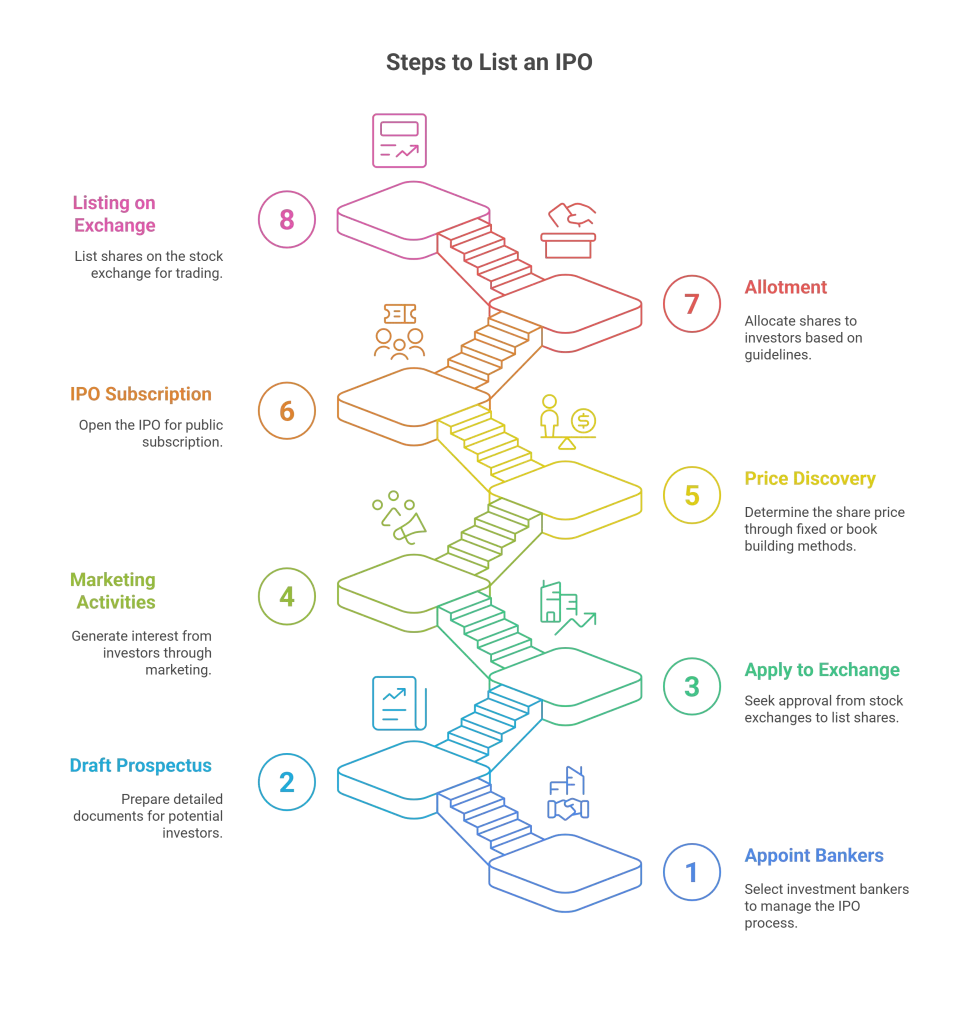

- Appointing Investment Bankers The company that wants to go public first appoints one or more than one investment banker, also known as an underwriter. The underwriter manages the entire process for the company by means of providing the required guidance, assistance with due diligence, and marketing the offering to potential investors.

- Drafting the DRHP & RHP The company, along with the investment bankers, conducts its assessment and due diligence on the company’s financial prospects and future growth potential and prepares a detailed document called the Draft Red Herring Prospectus (DRHP), which contains all the relevant information about the company for potential investors. On completing the preparation of DRHP, it is filed with SEBI for its review and feedback. SEBI reviews the DRHP to ensure all the necessary disclosures are made and the investors’ interests are protected. If required they may raise queries and seek the necessary clarification or amendments before giving approvals. Thereafter, the Red Herring Prospectus, containing the updated information, including the price band or final price, is prepared.

- Applying to the stock exchange The company applies to the stock exchanges seeking their approval to list shares of its company.

4.Marketing Activities The company and the investment bankers conduct various marketing activities to generate interest from potential investors (both retail and institutional) and analysts.

Price Discovery The company determines the price at which the shares will be offered to the public by:-

- Fixed Price Offering – The price is set by the company beforehand.

- Book building offering – A price band is announced, and the investors bid within that range. A final price is determined based on the demand for the company’s shares by the investors, which is a more common method.

- IPO Subscription The IPO is then opened to the public for a specified period. Investors can submit their application to buy shares of the company within this period.

- Allotment The shares are allotted to the investors based on SEBi guidelines.

- Listing on the Stock Exchange On completion of the allotment process, the company’s shares are listed on the stock exchange, and they begin trading on it.

Start Investing In Initial Public Offering(IPO)

What are SME IPOs ?

SME IPO or Small and Medium Enterprises Initial Public offerings, are designed to help smaller companies raise capital by listing their shares on dedicated platforms of the stock exchanges like NSE Emerge and BSE SME Platform.The listing norms for an SME IPO are relatively more relaxed than the mainstream IPO process.

What are the Key advantages of SME IPO ?

For SMEs

Access to Capital

Gives them a platform for raising the necessary funds for their growth and expansion plans.

Brand Image and Visibility

Increases awareness amongst the public at large and improves their credibility.

Liquidity for existing shareholders

Offers an exit route to venture capitalists and promoters.

For Investors

Opportunity to Invest Early

An investor gets to be a part of a high-growth company from the very nascent stage.

Diversification

Allows investors to look at it from the point of view of diversifying their risks.

Potential For High Returns

If the investment turns out to be a success, it can deliver potentially higher returns.

What are some significant risks involved in an SME IPO ?

For SMEs

Expensive Listing Costs

The entire process of listing can turn out to be a costly affair for an SME.

Increased Regulatory Compliance

A public company, be it an SME IPO or otherwise, is subject to stringent reporting and compliance requirements.

Loss of Control

In exchange for capital, the promoter may lose some control over the company.

Volatility in Prices

The prices of SME stocks are subject to more volatility due to much lower trading volumes.

For Investors

Higher Risk

The loss of capital for an investor of SME IPOs is higher compared to an established large company.

Liquidity Issue

Since the volume traded of an SME stock is much lower, getting to buy or sell shares at the desired price could you difficult.

Higher Investment Amount

The minimum investment amount for an interested investor is higher compared to mainstream IPO making it difficult for a small retail investor to participate.

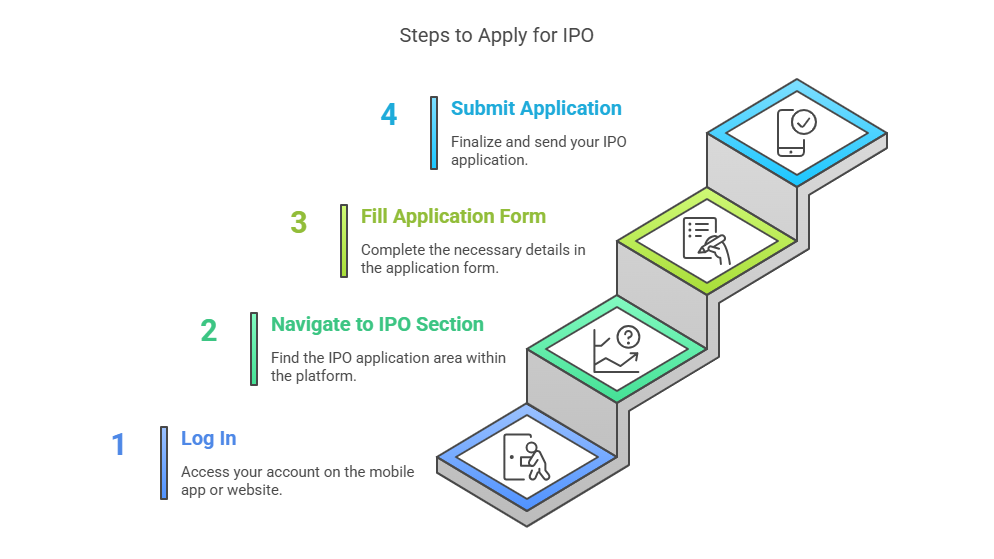

How to Apply for an IPO with us ?

As our customer, you can apply for an IPO through our Mobile App or from our website trading platform

Start Investing In Initial Public Offering(IPO)

FAQs

What is the difference between a Draft Red Herring Prospectus (DRHP) and a Red Herring Prospectus (RHP), and why should I be concerned about it?

The DRHP is the initial detailed document that a company, along with an investment banker, submits to the SEBI for its review and due diligence. It contains essential information about the company’s business, financials, potential risk, how it plans to use the money it has raised, etc. THE RHP is the updated and final version of DRHP, which contains information about the price band or the final price at which the shares will be offered to the investors.

As an IPO investor, you must read both the DRHP and the RHP, as they both help make a sound and informed investment decision rather than just following the crowd.

What is the book-building process? How does the price discovery method actually work in an IPO?

In a book-building process, the company announces a price range for the shares it decides to offer in the IPO. Interested investors then bid for the number of shares they are willing to buy along with the price that they are willing to pay for them. The company then determines the final price based on the bids received at various price points and determines the final issue price or the price at which the shares will be allotted.

As an IPO investor, you do not get to know the final price beforehand. Your bid within the price band is just one of the many bids received and contributes to determining the final price. If the demand for the shares is high, the prices might be closer to the upper band, whereas if the demand is lower, it would be closer to the lower band. It may so happen that you may also, at times, not get the shares at the exact price you big if the IPO gets oversubscribed.

Are SME IPOs riskier than the mainstream IPOs?How do I find out If an SME IPO is suitable for my risk appetite?

Yes, SME IPOs are riskier than mainstream IPOs as they have shorter operating histories, smaller scales of operation, and are more prone to volatility. Therefore, it is essential to understand the risks associated with an SME IPO, along with the potential for higher returns.

One of the ways to assess the risk associated with an SME IPO is to analyze the DRHP/RHP of the SME closely. They usually carry the following information, which needs to be carefully understood:-

- Financials: Carefully asses the company’s revenue, profit, debt and cash flow. Are they healthy and steadily growing?

- Industry: Does the company belong to an established sector or an emerging sector? What are the competitive advantages that this company has over its peers?

- Management Team: Who are the people leading this company? What experience do they bring to the table?

- Track record: How long has the company been in business? What has been its history of growth and profitability?

- Risk Factors: The DRHP/RHP explicitly states the risk associated with the company. As an investor you should pay very close attention to this.

Why is the minimum investment amount for an SME IPO higher than the regular IPO?

The minimum investment amount for an SME IPO is kept higher to discourage the very small retail investors who may not have the risk appetite for the volatility that comes with investing in them. The larger capital requirements attract more serious investors who would do the required due diligence before allocating larger capital.

For an SME IPO, the investment amount is usually around INR 1 lakh, unlike the regular IPO, which is around INR 10,000.

When can I sell the shares allotted to me in an IPO?

After the completion of the allotment process, stocks get listed on the stock exchange; after its listing, you can sell them anytime during the market hours. Usually, with more liquid companies, it is easier to sell their shares; however, with SME IPO, it might be difficult due to low trading volumes.