What is options trading ?

Options trading is a form of trading that gives you, as an options trader, the right to buy or sell a contract of an asset(like stocks, indices, commodities, or currencies) at a specific price on or before a particular date(called the expiry date). Options are derivative contracts traded in the stock market’s futures and options(F&O)segment. Unlike equity or shares, which represent a stake of ownership in a company, options do not have any inherent value.

They derive their value from the underlying asset(like stocks, commodities, indices, or currency pairs ).

Options are leveraged instruments. In other words, you can buy an option contract for a fraction of the cost of the underlying asset.

One key feature of options trading is that it gives you, as a trader or an investor, the right, not an obligation, to buy or sell the underlying asset at a predetermined price on or before a predetermined date. In other words, an option trader has the option to not buy the underlying asset at the predetermined price or date.

Key features of Options trading

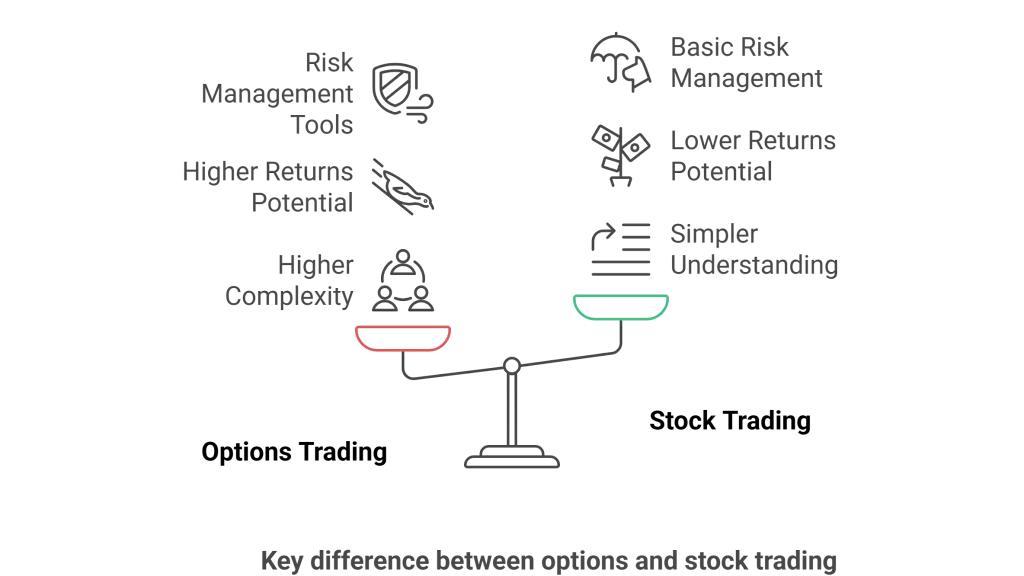

Options trading can make you significantly higher returns on your investment, provided you have the knowledge and expertise. On the flip side, the losses can also be considerably higher for you if you do not have the expertise and a complete understanding of how options work. You need to understand that options trading is more complex than stock trading.

- As an Options trader, you can hold the options contract(till its expiry date) at a fraction of the cost of the underlying asset.

- Professional options trader use hedging to limit their losses in case the price of the underlying asset goes against their view.

- An options seller must sell the underlying asset at the agreed price if the option buyer decides to close the options contract on or before the agreed date.

- An options contract between a buyer and seller of an option is merely recorded at the stock exchange. No paperwork is signed or exchanged between the buyer and seller.

Open Your Options Trading Account Now !

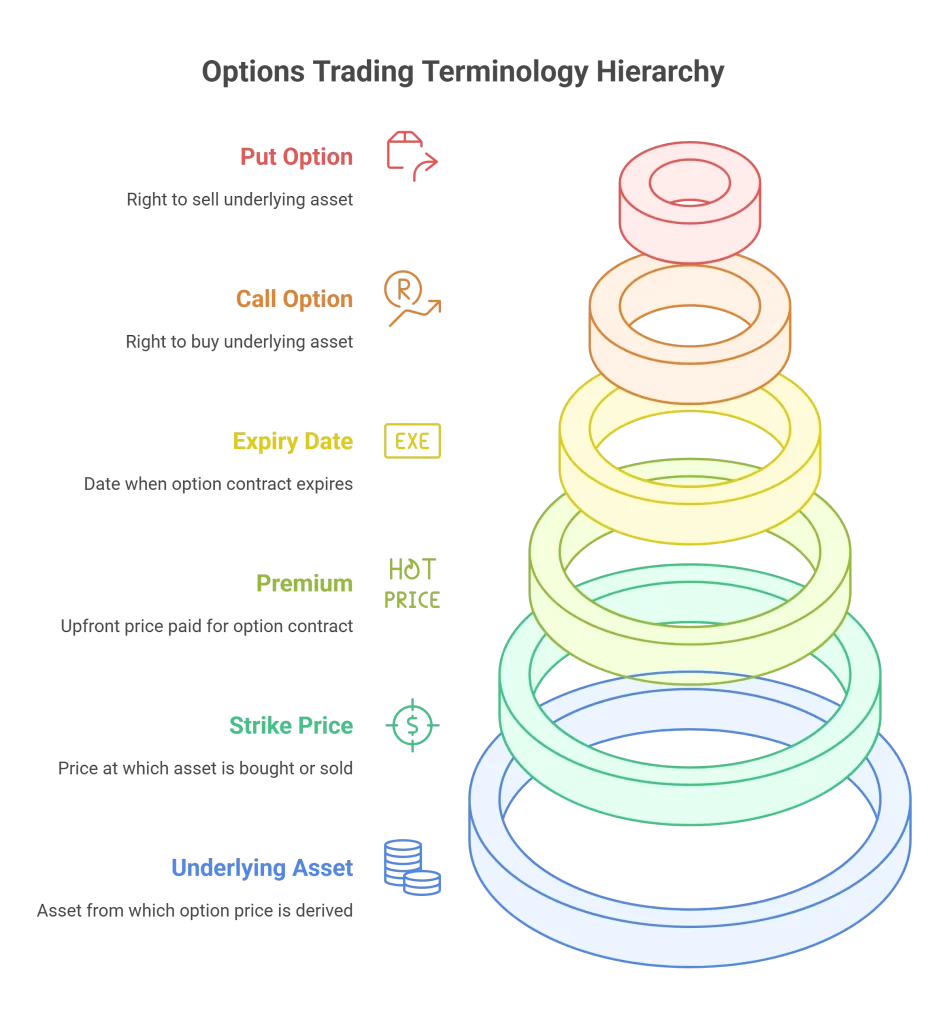

Key Terminologies That An Option Trader Must Know

Before you start trading in the options market, you must be aware of the terms used or linked to the options market:-

- Underlying asset: Are assets like stocks, indices, commodities, or currencies from which the option contract derives its price.

- Strike Price: The price at which the underlying asset is bought or sold is called the strike price. Depending on the instrument, the strike price is determined by the stock exchange and is in the public domain.

- Premium: The upfront price paid by the option buyer to the option seller of the option contract.

- Expiry date: The predetermined date the option contract ceases to exist or expires.

- Call Option: A buyer of call option has the right to buy the underlying asset. A call option buyer is bullish on a particular asset.

- Put Option: A buyer of the put option has the right to sell the underlying asset. A put option buyer is bearish on a particular asset.

Option Trading – Hedging With Options

Since the potential for losses is significantly higher in options trading, most professional investors use hedging to protect themselves from significant losses.

Hedging in options trading is a mix of strategies to minimize potential losses if the investor’s view is wrong. Simply put, hedging is like buying insurance.

Let us understand with an example:–

Say you own 100 shares(assuming 1 contract=100 shares) of a Company ABC bought at Rs 1000 per share and you decide to hold these shares for the long term. After buying, you are worried that the prices may drop below your purchase price.

As insurance against potential loss, you buy a put option at a 900 strike price, giving you the right to sell the shares if the price drops further.

This option’s contract acts like insurance, limiting your losses below Rs900.

Open Your Options Trading Account Now !

Options Trading – Speculating With Options

Speculating in options involves taking a position in the options market in anticipation of the price moving in a particular direction of an underlying asset. The goal is to profit from the price movement, unlike in hedging, where the goal is to minimize the risk.

Often, a speculator seeks to maximize their gains, even if it means taking on a significant risk to profit from the price movement.

Let us understand with an example:-

Say Nifty 50 index is at 23000. Let us assume that based on your analysis, you have the view that the price of Nifty 50index will go up. You buy a call option of 23200, which gives you the right to buy Nifty 50 at 23200. If the index rises above 23200, before the expiry date ,you stand to gain. However, you lose the premium amount paid if it stays below it on the expiry date.

What is an Options Trading account ?

An options trading account is the same as your equity trading account. Since options are derivative contracts, any trader who wishes to trade in options should first get the future and option segment activated by contacting his stockbroker. The trader must fulfil Specific KYC requirements before the broker activates the customer’s future and option trading segment.

Key reasons for the popularity of options trading

- Highly leveraged investment: With a small capital, a trader can hold an options contract until he chooses or the expiry date (whichever is earlier) to make a profit. Usually, the return on investment is high, which is the primary motivation of options traders.

- High Liquidity: Getting in and out of the options market is relatively easy, with minimum slippages.

- Lower transaction cost: Government duties, taxes, and commissions are relatively low now.

- Excellent tool for hedging: Options are great instruments to hedge your portfolio against any sudden or dramatic price fluctuations in the stock market.

- Efficient and well-regulated markets: The options market is well-regulated by SEBI in india.They ensure that all market participants strictly follow the rules and regulations, thus ensuring integrity, transparency, and investor protection.

- Standardized contract size: Option contracts are standardized and have uniform specifications regarding lot sizes, expiration dates, and strike prices. The stock exchange decides them; the details are in the public domain.

Key reasons for the popularity of options trading

- Highly leveraged investment: With a small capital, a trader can hold an options contract until he chooses or the expiry date (whichever is earlier) to make a profit. Usually, the return on investment is high, which is the primary motivation of options traders.

- High Liquidity: Getting in and out of the options market is relatively easy, with minimum slippages.

- Lower transaction cost: Government duties, taxes, and commissions are relatively low now.

- Excellent tool for hedging: Options are great instruments to hedge your portfolio against any sudden or dramatic price fluctuations in the stock mar

How to Activate your options trading account ?

Opening your Demat account is now a digital process. A Demat account is your first step to invest or trade in the stock markets .To activate the derivatives segment, you first need to have an active demat cum trading account We offer our customers a seamless,100% online account opening process, which takes just 15 minutes*. Let us understand the step-by-step process:-

STEP 1

STEP 1

Fill in your basic details.

STEP 2

STEP 2

Upload mandatory KYC documents

(like PAN, Aadhar card, and cancelled cheque).

STEP 3

STEP 3

Post verification, your demat cum trading account is activated.

STEP 4

STEP 4

To activate the Options F&O segment, proof of income is to be submitted; this can be done 100% online via our app or website.

Open your FREE* Demat account with us in 15 minutes and join the other 29lakh+ investors and traders

Open Your Options Trading Account Now !

FAQs

In Options trading, what exactly am I buying when I buy an options contract?

Unlike stocks, when you buy an option, you are not buying ownership in a listed company. Instead, you buy the right (but not the obligation) to buy or sell an underlying asset at a specific price on a particular date(the expiry date ). Options themselves do not have any inherent value. Their value is derived from the price movement of that underlying asset.

How do I use call options and put options in my options trading?

Call option: If the price of an asset(a stock, commodity, or index) goes up, you might buy a call option. The call option lets you buy that asset at a specific price before a certain date. If the prices of that asset go above that strike price,before the expiry date you may stand to gain.

Put Option: If the price of an asset goes down, you might buy a put option, which gives you the right to sell that asset at a specific price before a certain date(called the expiry date ). If the price goes below that strike price, you can profit.

How do I understand the difference between hedging and speculation?

Hedging:- is like buying insurance by paying a small upfront cost called the premium. Traders who trade the stock markets professionally or investors use options to protect their existing investments from potential losses.

For example, if you own shares of a company and are worried about the prices falling below a certain level, you may buy a put option as a protection.

Speculating:- The process of anticipating the price movement of an asset and taking up positions accordingly in the market is called speculation. Essentially, you are betting on whether the price of an asset will go up or down.

Speculating with options can be risky, and a sound understanding of hedging techniques would be helpful, especially for managing your risk.

Can I use my regular trading account, or do I need a special type of account for options trading?

For trading options, you do not have to open a separate account. However, you need to speak with your stockbroker and activate the future option segment in your account. For this, you might have to fulfil some additional KYC requirements and after verification, you will get a confirmation regarding the segment activation from your stockbroker.

What key risks should I know before I start options trading?

Options trading is considered more complex and riskier than traditional stock trading due to the following key reasons:-

- Leverage: While options give you the power to control a prominent position with much less capital than a stock, the chances of incurring a significantly higher amount of losses are also very much there, in case you are wrong.

- Time Decay: Options have an expiry date. The closer you are to the expiration date, the quicker the decay in the prices of an option is, even when the cost of the underlying asset does not move.

- Volatility: Unlike the prices of a stock, option prices get significantly impacted by the change in volatility of the underlying asset.

- Complexity: Compared to stock trading, options trading is significantly more complex and can be challenging for beginners.