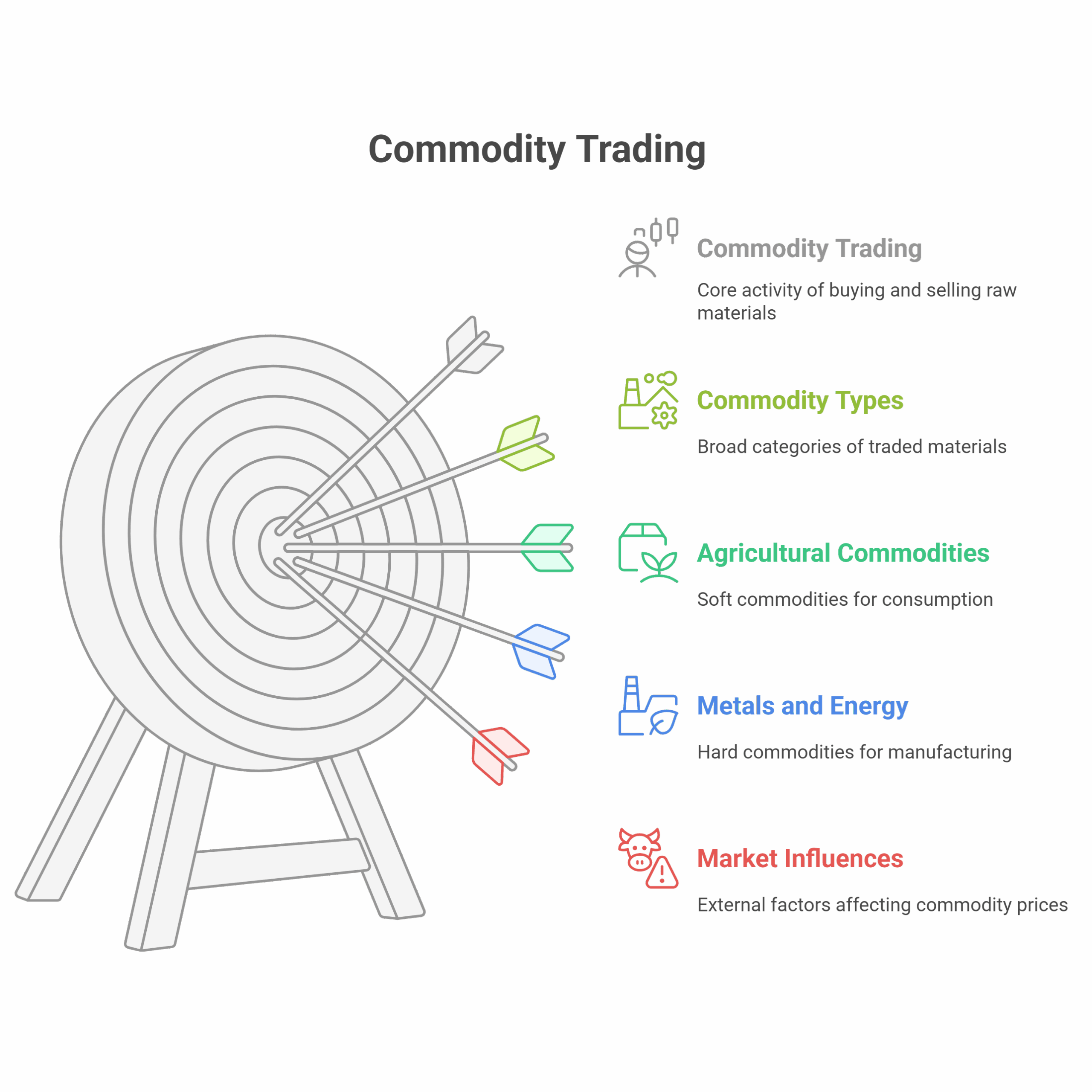

What is Commodity Trading ?

Commodity Trading involves buying and selling raw materials (like: primary agricultural products, metals, energy) used to manufacture finished products for further consumption. Some examples of commodities are: crude oil, gold, silver, wheat, soy, lead, aluminum,and many such commodities.

Commodities are broadly categorized under :

- Agricultural commodities: Wheat, Soy, Cotton, and other such raw materials

- Metals: Gold, Silver, Aluminum

- Energy: Crude Oil, Natural gas

Agricultural commodities, or soft commodities, are used for human consumption. In contrast, metals and energy, known as hard commodities, are put through further manufacturing processes to provide goods of value.

The hard commodities are mined or extracted, whereas the soft commodities are agricultural products.

Unlike the stock markets, commodity markets are prone to disasters like weather, epidemics, tsunamis, volcanic eruptions, etc. All these affect the demand and supply of the commodity and, therefore, its prices.

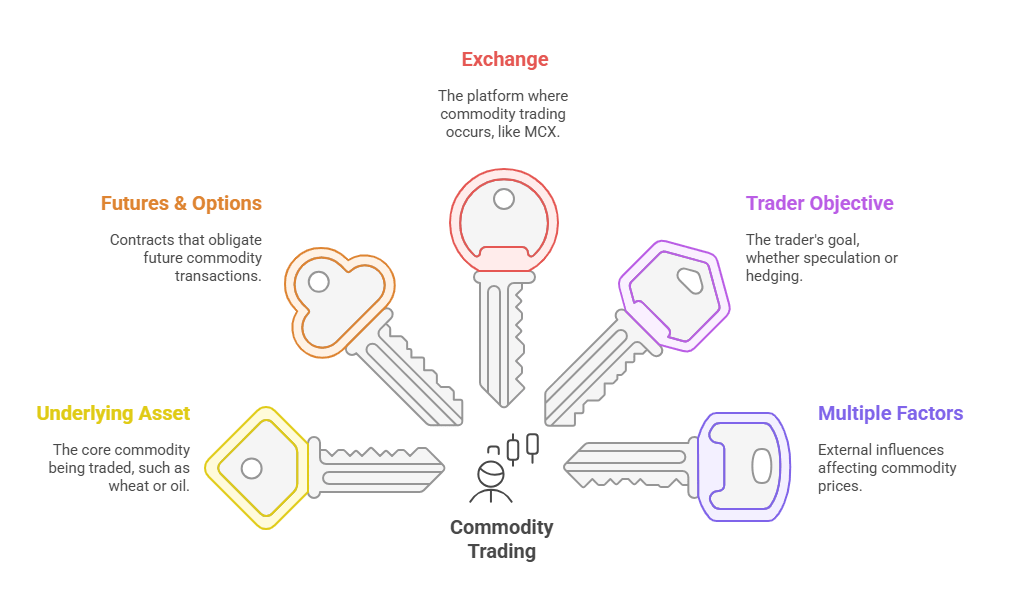

Key features of commodity trading

Underlying Asset The underlying is the commodity itself, like wheat, crude oil, gold, etc.

Futures &Options Contract Buying and selling in the commodities exchange is done through the futures and options contract. These contracts are obligatory; therefore, the buyer must buy, and the seller must deliver the specified quantity of the commodity at a pre-determined price and date on the contract expiry date.

Exchange In India, commodity trading is carried out on MCX(Multi Commodity Exchange).

Objective Of The Trader The trader buying and selling in the commodities market could be to speculate or hedge his positions.

Multiple Factors Like demand and supply, weather conditions, economic factors, geopolitical events, etc., affect a commodity’s prices.

Open Your Commodity Trading Account Now !

Who are the participants in the commodity market ?

Unlike in stock trading, the participants in the commodity market are not involved in buying or selling equity in a publicly listed company. They are here for one of the two reasons :

To Hedge

The hedgers are typically large manufacturers or producers of a commodity who take positions in the commodities market to hedge or minimize their risk in case of any untoward incident. For example, a large manufacturer of aluminum,holding raw materials at higher prices might lose if the price of aluminum starts falling. In this case, the manufacturer can sell or short contracts of aluminum to reduce the chances of a loss if the prices fall. The manufacturer can make money in the commodities futures market by shorting to offset the losses if the prices drop in the local market. On the other hand, gains made in the local market can offset the losses experienced in the futures market.

To Speculate

Speculators are market participants who try to profit by predicting the underlying asset's price movement. They spend time and effort crunching numbers, analyzing data, studying chart patterns, etc., before placing their trades. They go long in a contract if they feel the prices will go up and short in case they think the prices will fall. In either case, long or short, a speculator’s objective is to profit from the price movement of a commodity while minimizing its risk.

Key advantages Of opening a commodity trading account

Diversification

Commodities allow equity or bond investors to diversify their portfolios. Since commodity and stock markets have low co-relation, one may act as a hedge or a safeguard against the other.

Protects you against inflation

A commodity investor usually invests in the underlying raw material contributing to inflation. As inflation goes up, the value of your investments, too, acting as an overall hedge to your portfolio.

Liquidity

Entry and exits are quick and efficient as the commodity market is always bustling with activity.

Regulated and transparent

The commodities markets in India is well-regulated just as the stock markets.

How do you open a commodity trading account ?

Opening your demat account is now a digital process. A demat account is your first step to invest or trade in the stock markets .To activate the commodities trading segment, you first need to have an active demat cum trading account We offer our customers a seamless,100% online account opening process, which takes just 15 minutes*. Let us understand the step-by-step process:-

STEP 1

Fill in your basic details.

STEP 2

Upload mandatory KYC documents (like PAN, Aadhar card, and canceled cheque).

STEP 3

Post verification, your demat cum trading account is activated.

STEP 4

To activate the Commodity segment, proof of income is to be submitted; this can be done 100% online via our app or website.

And that’s it! We will let you know as soon as your segment is activated, and you can start trading in Commodities online.

As mentioned earlier, before trading in Commodities, you will need to deposit margin. So, don’t forget to do that before you place your first Commodity F&O trade!

Open FREE* Demat Account in 15 mins^ to join 29 lakh+ Investors & Traders

Open Your Commodity Trading Account Now !

Commodity Trading - Actionable Research To Empower You

Intraday Calls:

We give you calls based on our research team's recommendations to help you gain from the intraday volatility in the commodity future& options space

Fundamental And Technical Calls for Traders:

By giving out fundamental and technical calls, we aim to help traders with the necessary tools and information to make a well-informed decision.

Actionable Reports Throughout The Trading Day:

Morning View, Eagle Eye Commodities, and Riveting Metals are some reports we share with our customers.

Recommendations:

Get directional and non-directional recommendations from our team and make the best use of various market opportunities.

FAQ’s

What is commodity trading, and what kind of commodities can I trade?

Commodity trading involves buying and selling raw materials in the exchange, which are further processed before use. Broadly categorized into two segments – agricultural (wheat, soy, etc.) and non-agricultural (like gold, crude oil, etc.), they are the building blocks for many finished goods.The commodities allowed for trading in india can be seen here.

Who are the participants in the commodities market, and why do they trade these products?

Participation in commodity trading is done by two sets of groups

Hedgers: These are generally large companies that produce or use commodities in large quantities for further processing into finished goods. They take up positions to protect themselves against any adverse price movements.

Speculators: These are market participants who try to profit by predicting the direction the price may take of a particular commodity .

As a stock investor, in what way does spreading my investments in commodities help me?

Diversification: As a stock and bond investor, you must also spread your investments across non-correlated asset classes. Since the correlation between stocks and commodities is low, diversifying into commodities helps you balance your investment portfolio.

Hedge against Inflation: Investing in raw materials/commodities can protect against rising inflation.

Liquidity: Buying and selling commodities is relatively easy as the liquidity is high.

On which exchange does commodity trading take place?

Commodity trading is carried out in India’s Multi Commodity Exchange(MCX). Participation in commodity trading activities in the MCX happens through the future and options contract. To participate, you must contact your stockbroker, who will guide you further.

Will I have access to research reports and other insights to help me make informed decisions in my commodity trading journey?

Yes, we will give you actionable research to empower you in your commodity trading journey, which includes fundamental and technical calls. Regular research reports like Morning View, Eagle Eye Commodities, and Riveting Metals are also provided to make you an informed trader. Our team also gives directional and non-directional recommendations to help you capitalize on various market opportunities.