You don't need miracles in the west. You have insurance

A life insurance or a term life insurance plan is a contract between an individual(policyholder) and the insurance company. The contract is an understanding between the two wherein the insurance company promises to pay the nominee a pre-determined sum of money (upon the policyholder’s death) in exchange for regular payments called premiums.

Having life insurance is like an assurance that you as well as you family has incase of your untimely death .Apart from term life insurance plans, other policies offer benefits during the policyholder’s lifetime, namely maturity benefits, savings plans, and many such policies

Why gamble with uncertainty? Choose us instead.

A life insurance or a term life insurance plan is a formal agreement between a policyholder and an insurance company. Under this contract, the insurer guarantees a payout to the nominee in the event of the policyholder’s death, in exchange for regular premium payments.

Life insurance acts as a financial safety assurance — not just to cover loss of life, but to also offer structured plans that may include benefits like maturity returns and savings options. From basic term plans to more complex savings-linked policies, it’s designed to secure your family’s future in your absence.

What is Life Insurance?

A Financial Safety Net for You and Your Loved Ones

Imagine your family being financially stable even when you're not around. That’s what life insurance makes possible. It’s not just a policy—it’s a promise of protection. By ensuring a fixed payout in tough times, it acts as a cushion against life’s uncertainties.

Beyond just risk cover, modern life insurance plans go a step further—they help you save, invest, and grow wealth over time. Whether it's planning for your child’s education or your retirement, life insurance gives you peace of mind today for a more secure tomorrow.

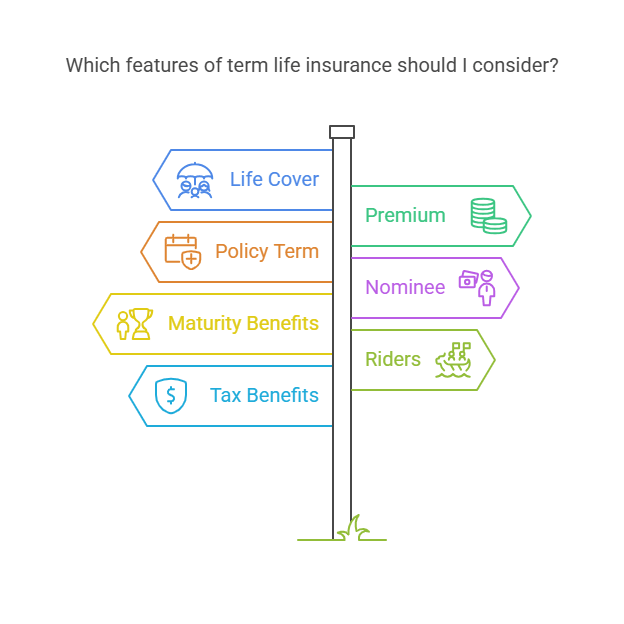

Key Features of Term Life Insurance

-

Life Cover: Guaranteed sum paid to the nominee in case of the policyholder’s death.

-

Premium: Fixed payments made regularly to keep the policy active.

-

Policy Term: Coverage is for a chosen duration, typically 10 to 40 years.

-

Nominee: The person(s) who will receive the death benefit.

-

Maturity Benefits: Some plans offer payouts if the policyholder survives the term.

-

Riders: Add-on covers like critical illness, accidental death, or disability.

-

Tax Benefits: Premiums qualify for tax deductions under Section 80C; death benefits are tax-free under Section 10(10D).

Why should you have Life insurance ?

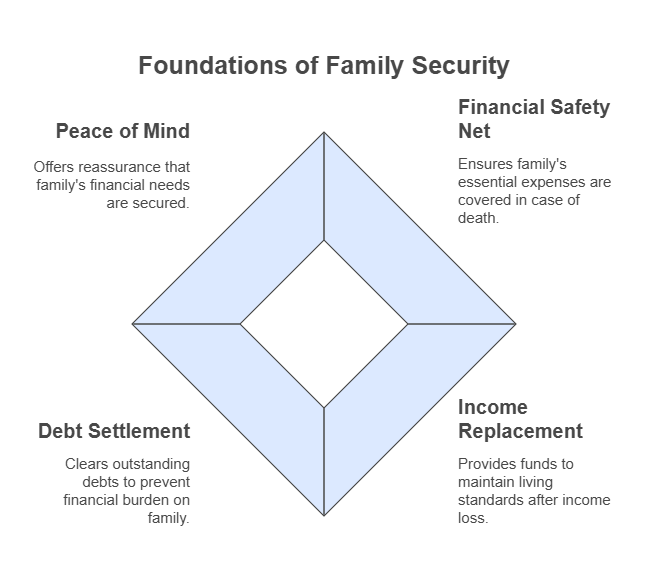

Securing your family’s future: Having a Life cover ensures that your family has a safety net in case of your untimely death . The life cover ensures that their essential expenses are taken care of, any debt gets paid off, and their standard of living is not compromised.

Income replacement: If you are your family’s sole breadwinner , your absence could create a significant financial gap. A life insurance policy could replace your lost income by providing your family with the necessary funds to manage their day-to-day expenses.

Settle any Debt you owe: In case of your untimely death, the proceeds from your life insurance policy can be used to clear any outstanding debts you owe, thus preventing your family from any undesirable financial burden.

Peace of Mind: Knowing that your family’s financial needs will be cared for even in your absence gives immense peace of mind.

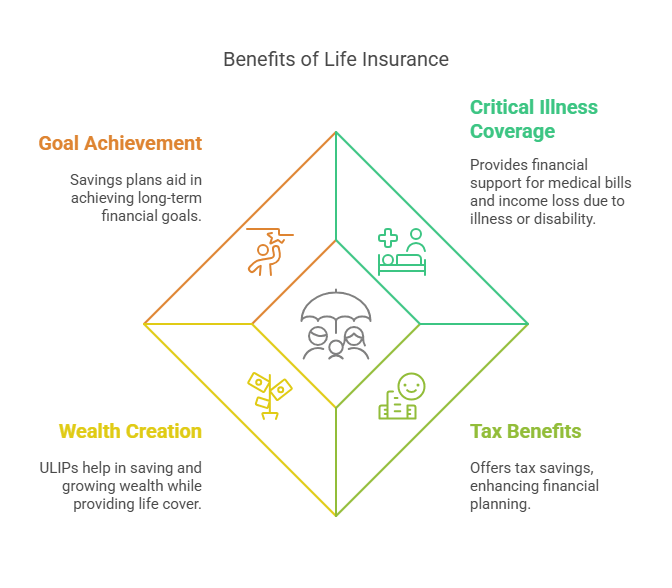

Critical illness & disability coverage: The riders that come along with the life insurance policy ensure that the desired financial support is given in case of any critical illness or disability, as it not only leads to significant medical bills but also loss of income.

Tax benefits: Tax benefits that come along with a life cover also help you save taxes

Long-term Wealth Creation: ULIPs (coming soon) allow you to save, create wealth, and give you life cover.

Achieve Long-term goals: A savings plan helps you achieve long-term financial goals like buying a property or funding your child’s education.

Types of Life Insurance Plans

Term Life Insurance Plan

Offers pure protection for a specific term. In case of death during the policy term, a lump sum is paid to the nominee.Endowment Plan

Combines life cover with savings. Ideal for those looking to build wealth while staying insured.Unit Linked Insurance Plan (ULIP) – Coming Soon

A dual-benefit plan that provides life cover along with investment opportunities in market-linked funds.Annuity Plan

Designed for retirement. Ensures a steady income stream through regular payouts in return for a lump sum investment.

HDFC Click 2 Protect Elite (UIN: 101N176V01)

HDFC Life Click 2 Protect Elite insurance plan provides financial protection to your family wherein you pay for a limited duration and get covered for the whole policy term.

ICICI Pru iProtect Smart Life Cover Plan (UIN: 105N151V13)

ICICI Pru iProtect Smart gives you the flexibility to design your safety net so that you can protect your family’s future to ensure that they lead their lives comfortably without any financial worries, even in your absence. This plan offers you the option to enhance your coverage against Accidental Death and Accelerated Critical Illnesses, hence ensuring a 360-degree cover on your life.

HDFC Click 2 Achieve (UIN: 101N186V03)

It is a non-participating, non-linked, savings insurance plan that helps you to achieve your goals while also safeguarding your family’s future against unforeseen events. HDFC Life Click 2 Achieve is meticulously designed to offer versatility, presenting you with a spectrum of options to safeguard your loved ones' futures and attain your financial objectives.

HDFC Life Sanchay Par Advantage (UIN: 101N136V03)

HDFC Life Sanchay Par Advantage is an individual, non-linked, participating savings life insurance plan that provides an option to choose life cover for a fixed policy term of 20 to 40 years or for whole of life (till the age 100 years). The plan provides a holistic solution for you to generate a regular income and to build a corpus to achieve the planned goals and secure your loved one’s future, without any compromises.

ICICI Pru Gold (UIN: 105N190V03)

ICICI Pru Gold is a protection and savings oriented participating life insurance plan that provides the protection of life cover along with a regular income for your chosen policy term or whole of life that can be used to meet your long-term recurring financial needs through participation in bonus.

ICICI Pru GIFT Pro (UIN: 105N201V05)

ICICI Pru GIFT Pro, is a protection and savings-oriented life insurance plan which helps you build a safety net to provide financial protection to your family along with Guaranteed Income and Guaranteed Money Back Benefit.

Get started

Schedule your personalized consultation today!

We are better together.

Drop your contact details into the form, and we’ll reach out to you!

OR REACH US AT:

C-72, East End Apartment,

Mayur Vihar Phase-I, Extension,

Delhi-110096

T: +91 88004-77472

E: info@safalfinedge.com