Insurance : Your Safety Net In A Risky World

What is Insurance ?

Simply said, it is a financial agreement between you (the policyholder) and insurance company(the insurer) .

As a policyholder, you pay sum of money called premium to the insurance company who in return promises to cover specific financial losses that you might incur in the future , due to predefined events .

Another way to look at it is to see it as a safety net designed to protect you and your loved ones from unexpected financial burdens which may arise in your life anytime and anywhere in future . Instead of bearing the full financial impact yourself , you share that risk with a large group of other policyholders, managed by the company.

What are the different types of options available ?

Insurance companies cater to a diverse range of needs of the policyholders .Some of the fundamental types include :

Life : provides a financial payout(death benefit) to your designated beneficiary(s) upon your demise. If you are adequately covered for, it can help your family cover any debts and fund their future goals .

Health : As the cost of healthcare has risen over the years , having health cover has become extremely crucial . It helps cover medical expenses arising from illness , injury or hospitalization, reducing the financial strain of healthcare .

Motor: Legally mandated , motor cover protects you financially if your vehicle is involved in accident, gets damaged or stolen . In some cases, it also covers third party liabilities .

- Home : Covers your home and its contents against various dangers like fire , theft , natural disasters and more .

- Travel : Suitable for travelers , as this covers unexpected financial events during a trip , such as medical emergencies , lost baggage or trip cancellation .

- Property : Covers a broader category that could include coverage of your home and cover other types of property like commercial buildings.

Apart from some of the popular policies mentioned above , there are other coverage options also for a policyholder like Liability insurance , Unit Linked Insurance Plan , Retirement Plans , Child plans and many more .

Why Was Insurance As A Product Discovered ?

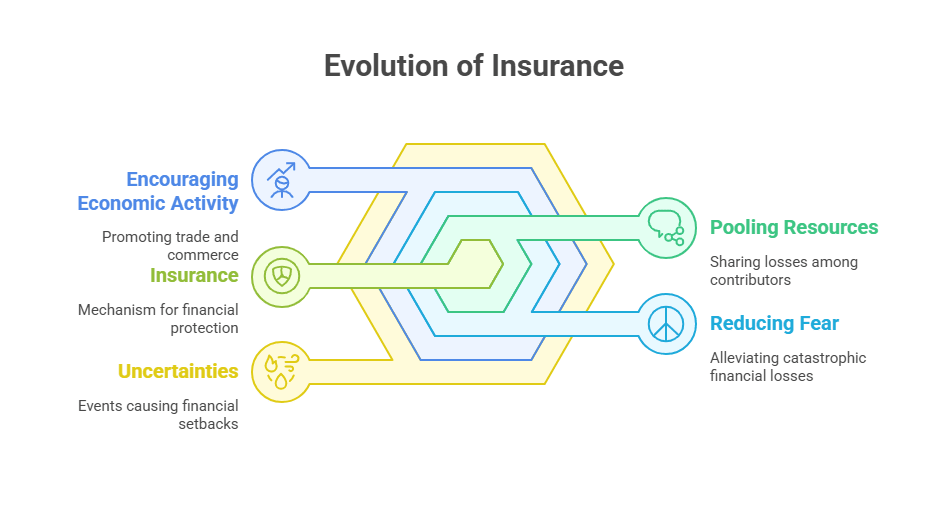

The concept of protecting yourself from uncertainties arising out of events that could set you or your loved ones back financially gave birth to the concept of Insurance . Throughout history , people or communities at large have devised ways to share these losses.

Today, as the concept has evolved and with the growth of trade and commerce, individuals and companies face potential financial ruin from events like fire, crop failures ,war, earthquakes and many more such events which is beyond their control .

Insurance provided a mechanism to pool resources, allowing those who suffered a loss to be compensated by the contributions of many. This system reduced the fear of catastrophic financial losses and encouraged economic activity .

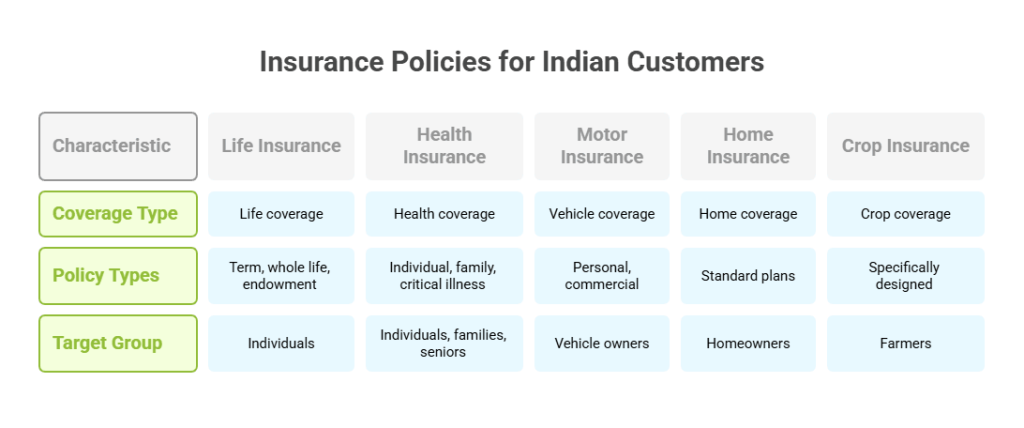

What are the different types of policies available to a customer in India ?

An Indian customer has access to a wide range catering to a diverse need which they may have . These includes :

- Life : Apart from the standard term plans ,a customer also has the choice to go with a whole life insurance policy , endowment plans , money-back policies and unit link insurance plans ,depending on his requirements and financial goals

- Health : Individual health plans ,family floater plans , critical illness plans , senior citizen health insurance and disease specific policies are some other options available to you .

- Motor : Options of choosing between a personal and commercial vehicle is available to you depending on your need .

- Home : Covers your home against various risks.

- Crop : Specifically designed for farmers to protect them from losses from crop failure .

In conclusion , no solid financial plan of an individual is complete without it. By paying a regular premium , policyholders mitigate and pass on the risk to the insurance company, thus protecting themselves from any unforeseen financial losses that may occur in future . In India a diverse option of insurance products is available to customers, catering to their needs-life , health , motor insurance being some of the most popular policies which most customers take, thus extending essential financial security and peace of mind against life’s uncertainties.

FAQ’s

What is the basic principle behind insurance ?

The basic principle is risk transfer. By paying a pre-determined amount called the premium you transfer the risk to the insurance company . In return they agree to cover the specific financial losses that you might experience ,due to the pre-defined events .

Can you name three key types and what they primarily cover ?

Yes , the three key types are :

- Life : Gives a financial payout to the beneficiary upon the death of a policyholder.

- Health : Helps cover medical expenses that may arise due illness or injury .

- Motor : Protects against financial losses arising from vehicle accidents, damage or thefts .

Is health insurance essential in India ?

Yes , it is a must for everyone, as the healthcare costs have risen dramatically in the last few decades . It helps you and your family cover medical expenses without facing any sudden or severe financial strain in case of illness or injury .

Besides life ,health and motor insurance , what are other popular types of options available to a customer in India ?

Beyond the widely popular Life , Health and Motor insurance , customers in India have access to several other important types . These include Home insurance-to protect your property, Travel -for unforeseen events during trips, Crop – specifically designed to protect farmers from crop losses and many more .

How does it help in managing financial risks for me and my family ?

A solid financial plan is incomplete without insurance .It provides essential financial security and peace of mind incase of any unexpected events in your life – like a medical emergency ,vehicle accident , loss of life . In other words, it acts as a financial net and protects your savings and ensures your family’s financial stability .