Investor: Building Wealth For The Future

In the realm of stock markets, an investor is an individual who invests his capital In financial assets like stocks, bonds, and mutual funds, with a long-term perspective ranging from several years to sometimes even decades.

Unlike a trader who is focused on making a quick profit from short-term price fluctuation, an investor’s objective is to grow their wealth steadily over a longer duration of time. Investing stratergies involve capitalizing on the growth in asset prices and the income derived from dividends or interest.

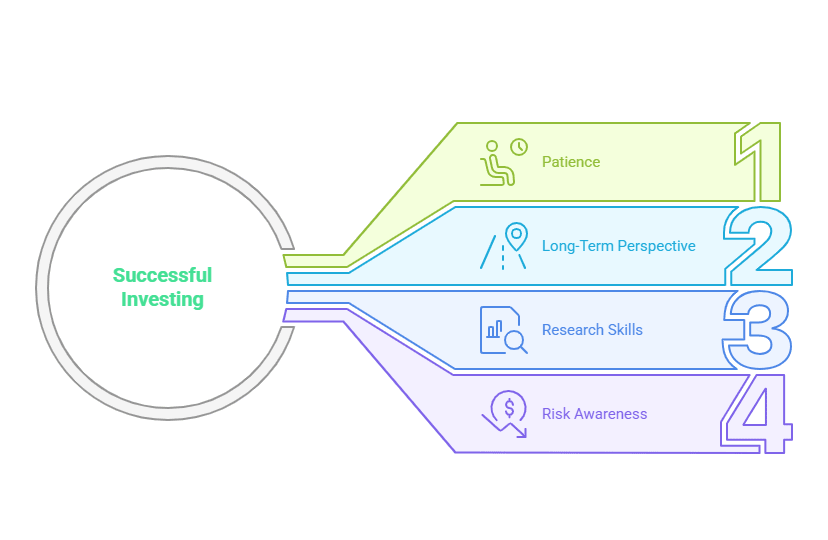

Achieving success in investing depends on cultivating specific traits like patience, the capacity to conduct rigorous research, a well-informed understanding of all the risks involved and remaining committed to a long- term investment horizon .

- Patience is paramount for an investor as the investment grows and rewards the investor over the long term. During the investment period, an investor must endure market fluctuations without losing sight of his long-term objective.

- A long-term perspective is crucial to remain focused on the eventual objective of investing in a security and avoid impulsive reactions to short-term volatility.

- Rigorous research skills are essential for identifying fundamentally strong companies and understanding their potential to grow within their respective industries.

- Being aware of risks involved with investing is important for making informed decisions that aligns with individual risk tolerance and financial objective.

Open Your Demat Account Now !

What is the underlying motivation of an investor ?

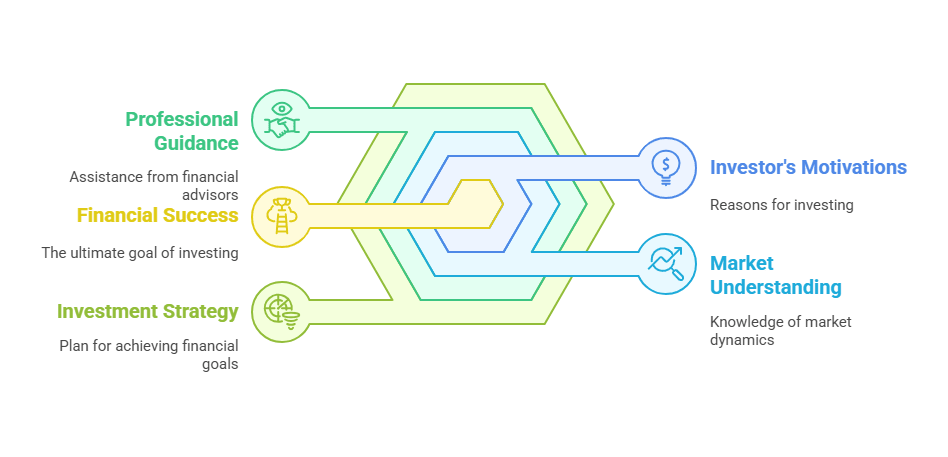

An investor is motivated to invest for varied reasons, but their ultimate goal is to achieve enduring financial success .Many invest in building wealth for retirement , fund their child’s education , buy a home, or even generate passive income over time . Investing in stock markets is also seen as a strategy to beat inflation and raise capital at a rate higher than the conventional bank deposits .

While the time horizon differs from trading, experience and proper education are equally crucial for a successful investing. A sound understanding of the fundamentals of a company and the sector to which it belongs,the prevailing economic trend ,the forex reserves, inflation,interest rates and many such numbers are critical to making an informed decision before investing. Experience plays a crucial role in investing, too, as it allows an investor to witness market cycles, learn from past successes and mistakes, and significantly refine their investment approach.

An investor keen to invest in the stock markets, for the long run must also understand the crucial role played by qualified individuals, in this business. Seeking professional guidance can significantly enhance returns on investment for an investor as the financial advisor takes into account many factors and then gives personalized advice tailored to meet an individual’s financial goals, risk tolerance, and time horizon. The expertise offered by them extends beyond the best-performing asset class, encompassing allocating adequate capital to different asset classes, constructing a long-term portfolio, efficient tax planning, and financial planning for specific life events.

They also help investors avoid common pitfalls, stay disciplined during market volatility, and develop a well-thought-out investment strategy that aligns with their investing objectives.

In conclusion, investing in the stock markets is a way to create wealth in the long run for individuals who adopt a patient , research-oriented approach and understand the importance of seeking assistance from qualified investment professionals to achieve their financial goals.