Professional Investment Management for High-Net-Worth Individuals

Portfolio Management Services (PMS) are a professional investment management solution designed for High-Net-Worth Individuals (HNIs), NRIs, and institutions. Provided by SEBI-registered Portfolio managers, this service allows investors to entrust their funds to an expert who actively manages their portfolio with the goal of achieving higher returns. Unlike a mutual fund where your money is pooled with many other investors, a PMS often offers a more tailored and personalized approach to investing.

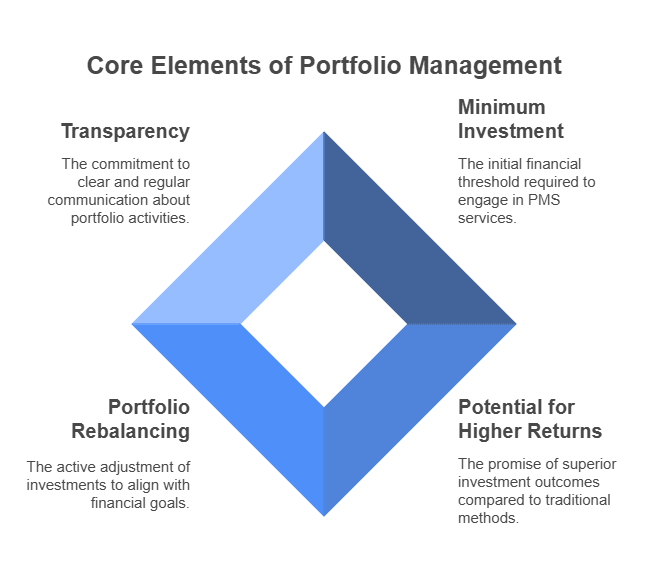

A key distinguishing factor of PMS is its minimum investment threshold. As per SEBI regulations, an investor must have a minimum of ₹50 lakhs to access this service. This significant entry barrier separates PMS from more broadly accessible investment products like mutual funds, positioning it as a specialized, premium service for affluent investors seeking a professionally managed portfolio.

Customized Investment Strategies

Thorough & Insightful Research

Active Monitoring and Management

Dedicated Relationship Support

The Advantage of Our Portfolio Management Services

Focus on Stability & Growth: We build your portfolio with a focus on stable, high-quality companies to create long-term wealth while minimizing risk.

Consistent, Reliable Returns: Our strategy aims for steady performance, reducing volatility and avoiding sudden swings during market turbulence.

Superior Risk-Adjusted Returns: We actively seek to deliver higher returns relative to the risk taken, aiming to beat the benchmark and optimize your investment outcome.

Our Portfolio Strategies for Confident Investors

Our Prime Picks strategy is a Quality Portfolio focused on proven wealth creators. We invest in companies with structural growth themes, sustainable multi-year earnings, and a strong competitive advantage. This long-term holding strategy is designed for low price volatility and low churning, aiming to provide stability to your portfolio and generate consistent, sustainable returns.

For investors seeking more aggressive growth, our Alpha Portfolios are designed to generate alpha returns. This strategy capitalizes on special situations, such as turnaround stories and short-to-medium-term opportunities, driven by temporary market inefficiencies. This approach is market-cap agnostic and uses a combination of long-term and tactical churn strategies, resulting in medium volatility and moderate churning. This flexible approach has no restrictions on investment tenure, allowing us to seize opportunities as they arise.

Key Features of Our Portfolio Management Services

Professional Management

A qualified fund manager with extensive experience handles all research, analysis, and management of your investments on your behalf.

Customization

We offer the flexibility to create and adjust your investment portfolio to match your specific financial goals, risk tolerance, and preferences.

Direct Ownership

Unlike mutual funds, you hold direct ownership of the stocks in your own demat account, providing a transparent view of your holdings.

Active Monitoring & Rebalancing

Your fund manager continuously monitors your portfolio, making timely adjustments to ensure it stays aligned with your investment objectives.

The Advantage of Our Portfolio Management Services

Focus on Stability and Long-Term Growth

Our approach is designed to build investor confidence by prioritizing stability. We focus on "quality compounders"—investments that steadily create wealth over the long term, avoiding high-risk, volatile securities.

Consistent Returns in All Markets

We aim to deliver consistent returns and minimize "pain" during volatile times. Our strategy is to avoid erratic performance and prolonged periods of unsustainable growth, providing a smoother investment experience.

Superior Risk-Adjusted Returns

We strive to generate returns that are higher than the benchmark for the level of risk taken. This focus on risk-adjusted returns is how we aim to deliver a favorable and optimized investment outcome for you.

Get started

Schedule your personalized consultation today!

We are better together.

Drop your contact details into the form, and we’ll reach out to you!

OR REACH US AT:

C-72, East End Apartment,

Mayur Vihar Phase-I, Extension,

Delhi-110096

T: +91 88004-77472

E: info@safalfinedge.com