Investiger - Stock Portfolio Curated by Experts

What is Investiger ?

Investiger , a proprietary product of Sharekhan,is a group of various stock portfolio was created to provide investors with eight different ready-made stock portfolios that align with a particular investment objective. This is helpful and important for an investor as it saves a lot of time and effort to research and select stocks one by one.

A combination of carefully selected stocks, in a stock portfolio ensures that, as an investor, you get better risk-adjusted returns on your investment. Our stock selection process is based on our 3R Research Approach.

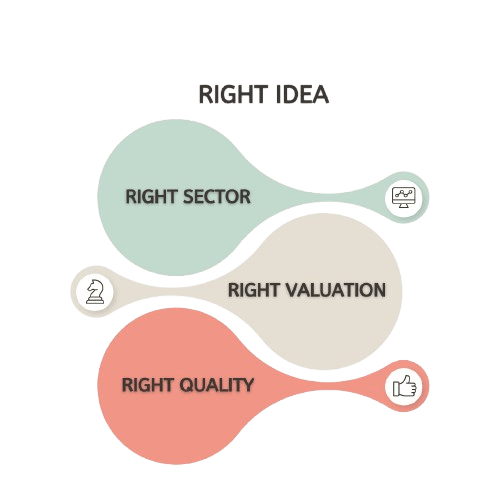

What is our 3 R Research Approach ?

Start Investing In Investiger

Our 3 R Research Approach is an in-depth analysis of a company’s fundamentals on three key matrices which we believe are fundamental for an investment to do well :

Right Sector

Identifying and narrowing down on a sector with strong growth prospects, from the long-term view, is fundamental to building a robust investment portfolio. The industry should exhibit a favourable structure with significant growth potential, a substantial addressable market, high barriers to entry, and resilience to shifts in government policies.

Right Quality

Our rigorous identification process helps us narrow down on companies with robust strengths like strong financials, distinct competitive advantage, a sound business strategy, and transparent management with a proven track record.

Right valuation

buying strong businesses at sensible prices is key for an investment to do well. Our identification process involves using various valuation metrics like PEG, DCF, relative valuation to its peers, and other essential methods that help us determine the right time to invest in a company.

* Investiger is a proprietary product of Mirae Asset Sharekhan

What are some Key Features of Investiger?

- Various Handpicked stock portfolios to keep you ahead of the markets.

- You can download the Investiger mobile app and start investing in any of our 8 ready-to-invest-in stock portfolios which meet your investment objective.

- Timely Research alerts ensure you can rebalance your portfolio in a single click.

- A low rebalancing rate ensures that the stocks require fewer adjustments based on short-term market fluctuations.

- You can choose from 8-stock baskets divided into two distinct categories (Premier& Thematic), empowering you to align your investments with your goals.

- With our experts by your side, you can aim for a better overall performance of your investments.

Open your FREE* Demat account with us in 15mins*

Start Investing In Investiger

*Govt taxes,Stamp duty, Education Cess, and other statutory levies if any, will be charged extra as applicable

Key advantages of Investiger

100% Transparency

Complete transparency in the structure of each stock portfolio and stocks that form each stock basket, with clearly defined objectives and past performance to evaluate

Proven expertise over decades

Now, experience the impact of our research-driven stock portfolio directly, helping you reach your goals with our investiger stock basket.

Active monitoring of all Portfolios

Our research experts keep a close watch on the performance of each stock basket, and any stock updates or rebalancing updates are shared with you instantly on the investiger mobile app.

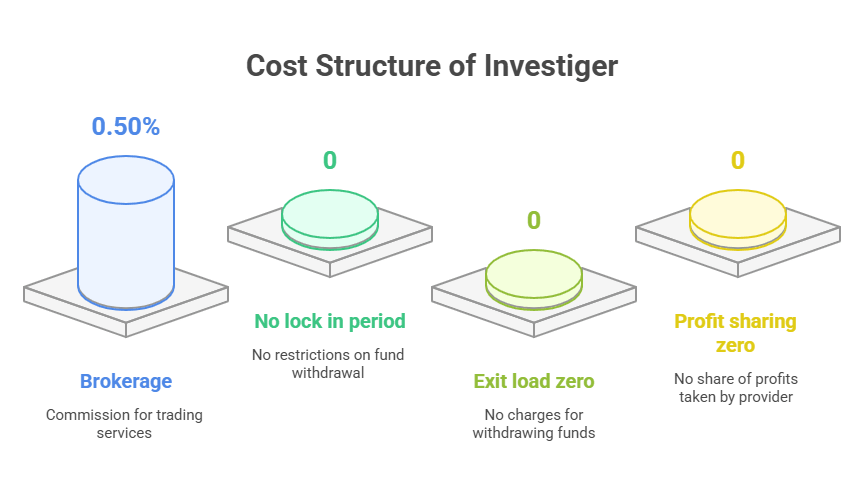

Cost-Effective

No management fees and no Profit sharing. Gain from the expertise of a professionally managed stock portfolio at a competitive brokerage rate of just 0.5%*

Strategic market timing

Identifying optimal entry and exit points is paramount to success in investing. With Sharekhan's expertise by your side, you can make smarter investment choices.

PREMIER

Well-balanced, diversified Stock Baskets

Power Portfolio

Power Model Portfolio is a large-cap-oriented, diversified portfolio of well-

researched quality companies with market cap of over Rs. 10,000 Cr.

Objective: Aims to outperform CNX Nifty 50 index

Minimum lump sum investment: Rs. 1 lakh

Minimum top up amount: Rs. 50,000

No. of stocks: 10

Risk: Balanced

Star Portfolio

Star Model Portfolio is a well-balanced multi-cap portfolio with a

mandate to invest in quality companies under Sharekhan coverage that have

market cap of over Rs. 5,000 Cr.

Objective: Aims to outperform BSE 200 and CNX Nifty 50 indices

Minimum lumpsum investment: Rs. 1 lakh

Minimum top up amount: Rs. 50,000

No. of stocks: 10

Risk: Balanced

Top Picks

Top Picks is an all-weather portfolio with a judicious mix of large-cap, mid-

cap and small-cap stocks with a passive strategy to review the portfolio once a month.

Objective: Aims to outperform CNX Nifty 50 and Sensex indices

Minimum lump sum investment: Rs. 1 lakh

Minimum top up amount: Rs. 50,000

No. of stocks: 11

Risk: Balanced

Emerging Stars Portfolio

Emerging Stars Portfolio is basically a combination of quality midcap and

smallcap stocks that have the potential to see solid scale in business over the

years. Suitable for investors who aim

Objective: Aims to outperform CNX Nifty Midcap 100 and CNX Nifty

Smallcap 100s

Minimum lump sum investment: Rs. 1 lakh

Minimum top up amount: Rs. 50,000

No. of stocks: 8 to 10

Risk: Aggressive

Start Investing In Investiger

THEMATIC

Stock Portfolio that capitalise on macro trends or investment themes

MNC Picks

MNC Picks is a stock basket of select high-quality multi-national companies that have a distinct competitive edge and a proven track record across many countries. Usually, these companies have healthy balance sheets and high standards of corporate governance.

Objective: Aims to outperform CNX MNC index

Minimum lumpsum investment: Rs. 80,000

Minimum top up amount: Rs. 50,000

No. of stocks: 5 to 10

Risk: Conservative

Economic Recovery Picks

Economic Recovery Picks is a portfolio curated to capitalize on the investment opportunities that would emerge from the expected multi-year upcycle in the Indian economy.

Objective: Aims to outperform Nifty 50 / CNX 500 indices

Minimum lumpsum investment: Rs. 50,000

Minimum top-up amount: Rs. 50,000

No. of stocks: 8 to 10

Risk: Balanced

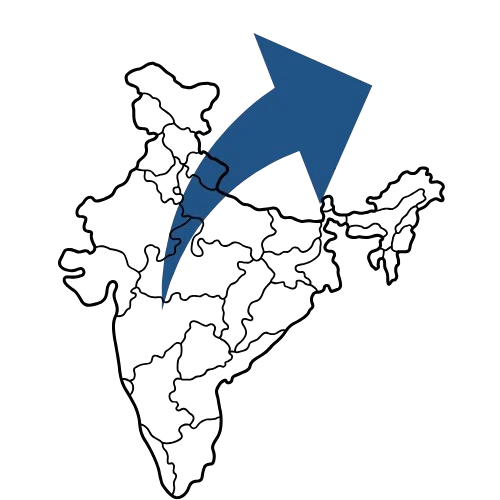

Export Picks

Export Picks is a stock basket of export-oriented companies that seeks

to leverage India Inc.’s huge export prospects, led by a healthy global

demand, policy initiatives at home and the China +1 policy.

Objective: Aims to outperform Nifty 50 index

Minimum lumps um investment: Rs. 50,000

Minimum top-up amount: Rs. 50,000

No. of stocks: 5-10

Risk: Aggressive

Green Model Portfolio

Green Model Portfolio is our stock basket centred around ESG, a fast-

evolving asset class globally. Exposures are taken post assessing a company

on 3 non-financial parameters: Environment Assessment, Social

Responsibility and Governance (Corporate).

Objective: Aims to outperform CNX Nifty 100 ESG

Minimum lumpsum investment: Rs. 60,000

Minimum top-up amount: Rs. 60,000

No. of stocks: 8-10

Risk: Balanced

FAQs

What is Investiger? How is it different from me choosing stocks on my own?

Investiger is ready to invest in a stock portfolio created by Sharekhan’s in-house team of research analysts. As an investor, you can choose where to invest from 8 distinct stock portfolios designed to achieve different investment objectives. Unlike picking individual stocks, where you must invest time and effort in research and selection, the investiger mobile app offers various pre-researched and actively monitored stock portfolios based on our 3 R Research Philosophy.

How are the stocks in each portfolio chosen?

Our in-house analysts handpick stocks for each investiger portfolio based on our 3R Research Approach. This involves deeply researching and analyzing a stock in the right sector of the right quality available at the right valuations

What kind of portfolios can I invest in with the investiger app? How frequently are they changed or updated?

Investiger offers eight stock baskets categorized into Premier and Thematic portfolio options, allowing you to choose based on your investment preferences and outlook. Our research team actively monitors these portfolios and provides timely research alerts for rebalancing, which can be done with a single click on the app. The rebalancing rate is kept low to minimize unnecessary adjustments and charges.

What are the costs associated with Investiger, and are there any hidden charges?

Investiger has a transparent cost structure. You only pay 0.5% of your transaction value as brokerage. There is no profit-sharing fee, exit load, or lock-in period on your investments made in any stock portfolios. Government duties and taxes will be extra as applicable on the brokerage charged.

How will Investiger help me make smarter investment decisions and improve my returns?

InvesTiger portfolios are constructed by our expert analysts through a rigorous selection process. These carefully curated stock baskets are actively monitored, with timely buy or sell insights provided to optimize your portfolio’s performance.